📈 WPI Inflation Updates: January 2026

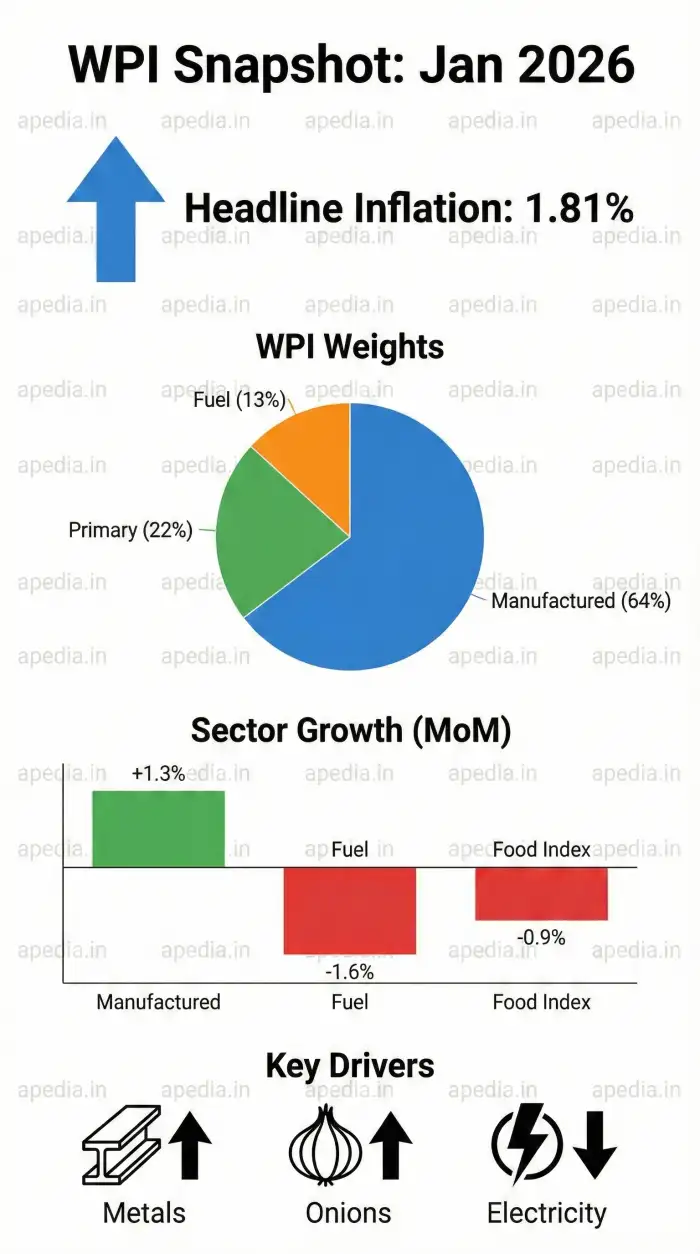

The annual rate of inflation based on the All India Wholesale Price Index (WPI) has risen to 1.81% (Provisional) for the month of January 2026. This marks a notable increase compared to previous months, primarily driven by price hikes in basic metals, manufactured products, non-food articles, and textiles.

1.81%

WPI Inflation Rate

0.51%

Month-on-Month Rise

157.8

Current WPI Index

📊 Sector-Wise Performance

The inflation data reveals divergent trends across major commodity groups. While manufactured products saw price pressures, the fuel sector witnessed a decline.

🏭 Manufactured Products

Holding the highest weight (64.23%), this group saw index rising by 1.30%. Key drivers were Basic Metals, Textiles, and Food Products.

🌾 Primary Articles

Prices decreased slightly by 0.15% month-on-month. While Non-food articles and Crude Petroleum became costlier, Food articles and Minerals saw a price dip.

⚡ Fuel & Power

This sector offered relief with a decline of 1.62%, largely due to falling prices of Electricity (-2.91%) and Mineral Oils.

🥣 Food Inflation Trends

The WPI Food Index decreased from 196.0 in December 2025 to 194.2 in January 2026. However, the annual rate of inflation for food items stands at 1.41%.

- 📉 Price Drop: Vegetables (-14.62%) and Potatoes (-20.70%) saw significant month-on-month cooling.

- 📈 Price Rise: Onions continue to remain volatile with an 11.48% increase in prices compared to December.

📚 Prelims Quiz Corner

1. Which organization releases the Wholesale Price Index (WPI) data in India?

Answer: C

2. Which component has the highest weightage in the WPI basket?

Answer: C

📝 Mains Practice Q&A

Q. Distinguish between Wholesale Price Index (WPI) and Consumer Price Index (CPI). Why is WPI still relevant for policy formulation despite the RBI targeting CPI inflation? (GS-3: Indian Economy) - 250 Words

Model Answer Synopsis

Key Differences

1. Basket: WPI focuses on goods traded between businesses (highest weight to Manufactured Products), while CPI measures retail prices (highest weight to Food & Beverages).

2. Services: CPI includes services (education, health), whereas WPI tracks only goods.

3. Publisher: WPI is released by DPIIT (Min of Commerce); CPI by NSO (MoSPI).

2. Services: CPI includes services (education, health), whereas WPI tracks only goods.

3. Publisher: WPI is released by DPIIT (Min of Commerce); CPI by NSO (MoSPI).

Relevance of WPI

Although RBI uses CPI for monetary policy (inflation targeting), WPI remains crucial for:

1. GDP Deflator: Used to arrive at real GDP.

2. Producer Costs: It reflects input cost pressures (fuel, metals) before they pass on to consumers.

3. Fiscal Policy: Helps the government in determining fiscal parameters and dearness allowance for certain sectors.

1. GDP Deflator: Used to arrive at real GDP.

2. Producer Costs: It reflects input cost pressures (fuel, metals) before they pass on to consumers.

3. Fiscal Policy: Helps the government in determining fiscal parameters and dearness allowance for certain sectors.

Source Information: PIB Release ID: 2228577 (Feb 16, 2026)

Link to Original Press Release

Ministry of Commerce & Industry