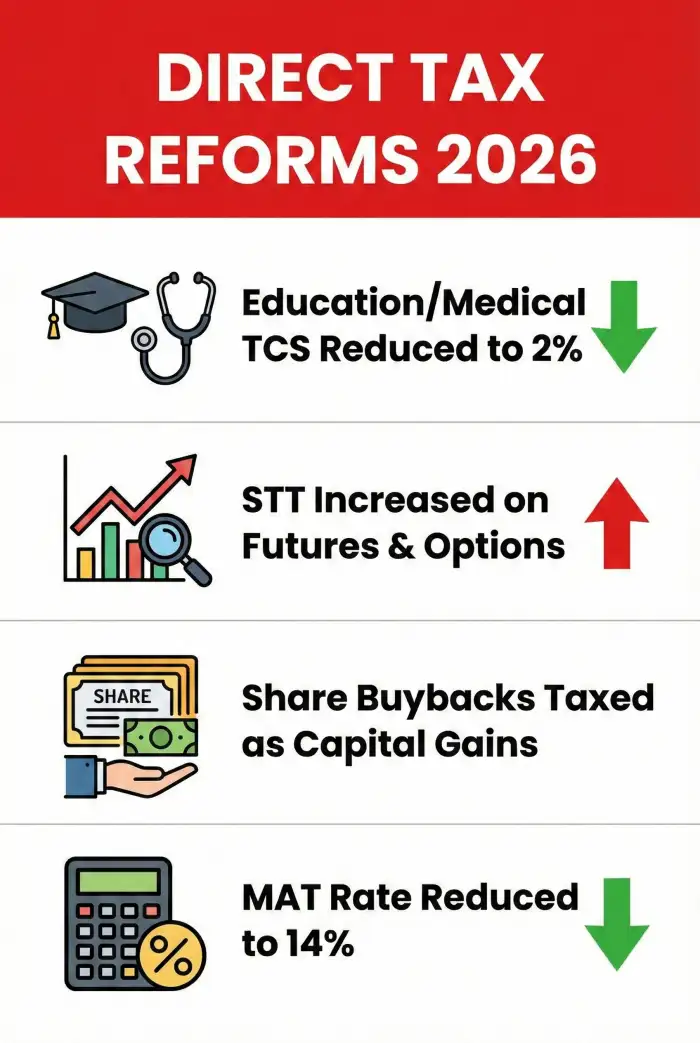

In a major push for structural reform, Finance Minister Smt. Nirmala Sitharaman announced pivotal changes to the direct tax landscape during the Union Budget 2026-27 presentation. Emphasizing simplification and compliance, the government introduced the timeline for the new Income Tax Act, 2025, alongside significant rationalization of Tax Collected at Source (TCS) and Securities Transaction Tax (STT).

Effective April 1, 2026

Reduced to 2%

Rationalized to 2%

Increased to 0.05%

Taxed as Capital Gains

- Implementation Date: The new Act will officially come into effect from 1st April 2026.

- Simplification: Rules and forms have been redesigned to be more user-friendly for ordinary citizens, with notifications to be issued well in advance to ensure taxpayers have time to adapt.

Significant relief has been provided under the Liberalised Remittance Scheme (LRS) and for specific goods:

- LRS Remittances: For amounts exceeding ₹10 lakh, the TCS rate is reduced to 2% for education and medical treatment purposes. (Note: It remains 20% for other purposes).

- Goods: TCS rates for alcoholic liquor, scrap, and minerals are rationalized to 2%. The rate for tendu leaves is slashed from 5% to 2%.

Share Buyback Taxation

To prevent tax arbitrage, buybacks will now be taxed as Capital Gains for all shareholders. Additionally, promoters will face an additional tax burden:

- Effective tax for Corporate Promoters: 22%

- Effective tax for Non-Corporate Promoters: 30%

STT Hike

Trading costs are set to rise with increases in STT:

- Futures: Increased from 0.02% to 0.05%.

- Options (Premium & Exercise): Increased to 0.15%.

- Minimum Alternate Tax (MAT): Proposed to become a final tax with no further credit accumulation starting April 1, 2026. The rate is reduced from 15% to 14%.

- Credit Usage: Companies shifting to the new regime can use brought-forward MAT credit to offset up to 1/4th of their tax liability.

Original Source: Ministry of Finance via PIB Delhi.