Introduction

- Tabled by Finance Minister Smt. Nirmala Sitharaman, the Economic Survey 2025-26 outlines India's robust economic performance.

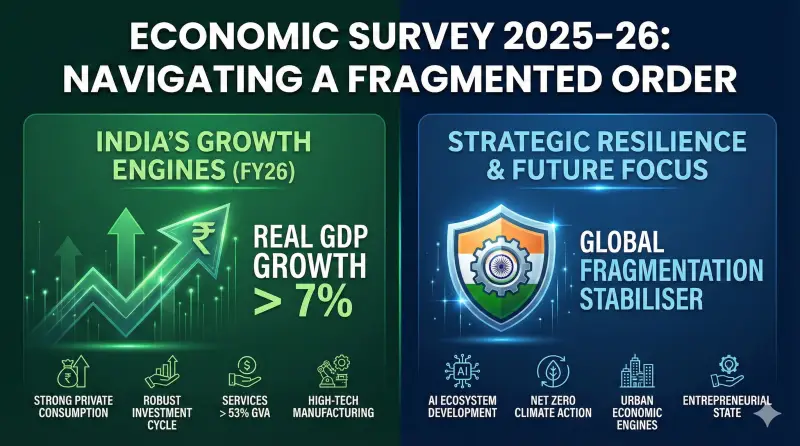

- The central theme focuses on navigating a fragmented global order by building Strategic Resilience and moving towards Strategic Indispensability.

- Despite global geopolitical frictions and trade fragmentation, India remains a stabilising power in the world economy.

- The survey emphasizes that the Indian rupee’s valuation does not fully reflect the country's stellar economic fundamentals.

Macroeconomic Snapshot

Real GDP Growth (FY26)

Over 7%

GDP Outlook (FY27)

6.8% - 7.2%

Retail Inflation (Apr-Dec '25)

Declined to 1.7%

Forex Reserves

USD 701.4 Billion

Fiscal Deficit (FY26 Target)

4.4% of GDP

Key Economic Drivers & Trends

- Investment & Consumption: Domestic drivers remain strong with Private Final Consumption Expenditure reaching its highest share in GDP since FY12.

- Capital Formation: Gross Fixed Capital Formation (GFCF) grew by 7.6% in H1 FY26, signaling a robust investment cycle.

- Services Sector: Continues to be the engine of growth, contributing over 53% to GVA, driven by Global Capability Centres (GCCs) and digital services.

- Manufacturing: A structural shift is underway towards high-tech manufacturing, aided by PLI schemes and the India Semiconductor Mission.

- Agriculture: Showed resilience with a growth of 3.6% in H1 FY26, supported by allied sectors like livestock and fisheries.

Strategic Focus Areas

- The "Entrepreneurial State": A call for the state to act as an enabler, moving from compliance to capability building and de-risking strategic sectors.

- Artificial Intelligence: The survey dedicates a chapter to the AI Ecosystem, advocating for a development-oriented approach to AI that balances innovation with safety.

- Urbanisation: Developing cities not just as dwelling places but as economic engines, addressing constraints in land, housing, and mobility.

- Climate Action: Balancing energy security with the Net Zero transition, focusing on adaptation and green finance.

Challenges & Risks

- Geopolitical Fragmentation: The global environment is marked by trade policy uncertainty and "geostrategic globalisation".

- Global Slowdown: External demand may face headwinds due to fragile global growth.

- Input Costs: While core inflation is low, specific food price volatilities and global commodity price shocks remain risks.

Source Information

Original Source: Department of Economic Affairs, Ministry of Finance, Government of India.

Frequently Asked Questions

Q. What is the GDP growth projection for next year?

The Survey projects real GDP growth for FY27 to be in the range of 6.8% to 7.2%.

Q. What is the theme of this year's survey?

The core theme is building "Strategic Resilience and Strategic Indispensability" in a fragmented global order.

Q. How is the inflation situation?

Inflation has been "tamed and anchored," falling to 1.7% in FY26 (up to December), driven by food disinflation.

Q. What is the status of the Fiscal Deficit?

The government is on track with fiscal consolidation, targeting a deficit of 4.4% of GDP for FY26.

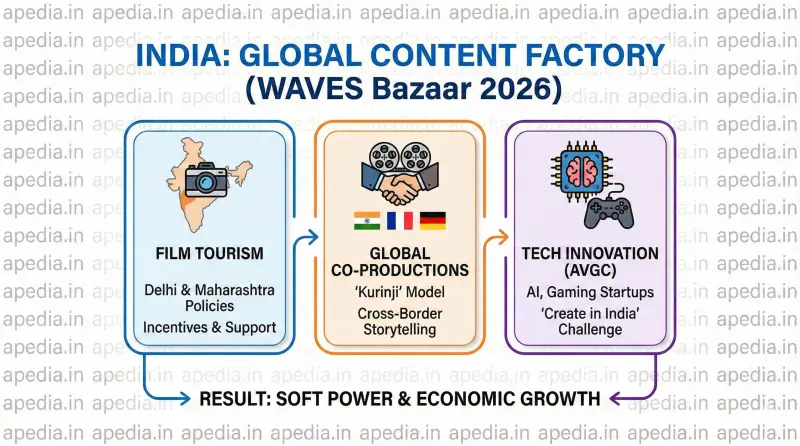

Q. What new sectors are highlighted?

The survey places special emphasis on Artificial Intelligence (AI), the "Orange Economy" (creative industries), and high-tech manufacturing.