Introduction

- Presented in the newly inaugurated Kartavya Bhawan.

- The budget is anchored by the spirit of 'Yuva Shakti' (Youth Power).

- Inspired by three core duties: Accelerating Economic Growth, Fulfilling Aspirations, and Ensuring Inclusive Development.

- Focuses heavily on the underprivileged and disadvantaged sections of society.

Key Financial Statistics

Public Capex

₹12.2 Lakh Crore

Fiscal Deficit Target

4.3% of GDP (BE 2026-27)

Biopharma Outlay

₹10,000 Crore

SME Growth Fund

₹10,000 Crore

New Income Tax Act

Effective April 2026

Taxation Reforms: Simplicity & Relief

- New Income Tax Act, 2025: A simplified Act will come into effect from April 2026 to reduce compliance burden.

- IT Sector Boost: A single category for IT services introduced with a common safe harbour margin of 15.5%.

- Safe Harbour Threshold: Significantly increased from ₹300 crore to ₹2,000 crore.

- Customs Duty Slash: Import duties on goods for personal use reduced from 20% to 10%.

- Exemptions: Customs duties exempted on 17 specific drugs/medicines and critical mineral processing equipment.

Infrastructure: The Growth Engines

- High-Speed Rail: Seven new corridors proposed as 'growth connectors' (e.g., Mumbai-Pune, Delhi-Varanasi).

- City Economic Regions: Allocation of ₹5,000 crore over five years to develop economic hubs.

- Freight Corridors: New dedicated freight corridors connecting Dankuni to Surat.

Social Welfare & Youth Empowerment

- Women in STEM: Establishment of one girls' hostel in every district to support female students.

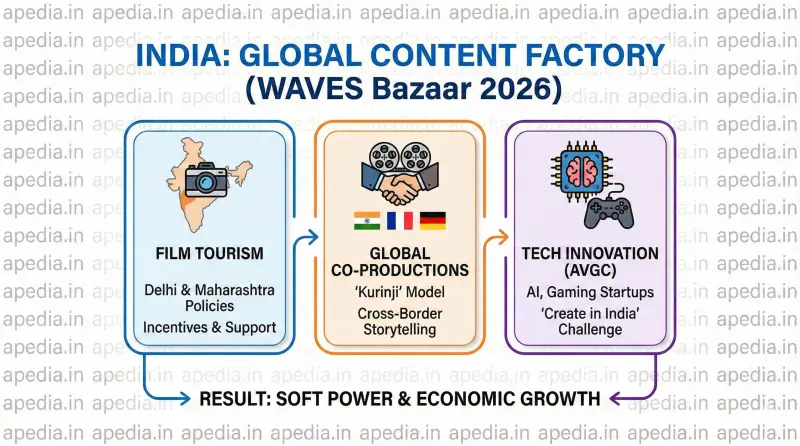

- Future Skills: Setup of AVGC Content Creator Labs in 15,000 secondary schools.

- Tourism Skilling: A new scheme to upskill 10,000 tourist guides in collaboration with IIMs.

- Poverty Alleviation: 25 crore individuals have escaped multidimensional poverty in the last decade.

Sectoral Boost: Pharma & MSMEs

- Biopharma SHAKTI: A massive outlay of ₹10,000 crores to build a domestic ecosystem for biologics.

- MSME Champions: Creation of a ₹10,000 crore SME Growth Fund to scale small enterprises.

- Textile Support: Launch of Samarth 2.0 to modernize the textile skilling ecosystem.

Source Information

Original Source: Ministry of Finance via PIB Delhi.

Frequently Asked Questions

Q. When will the new Income Tax Act come into effect?

The New Income Tax Act, 2025 is scheduled to come into effect from April 2026.

Q. What are the new High-Speed Rail corridors mentioned?

Seven corridors were announced: Mumbai-Pune, Pune-Hyderabad, Hyderabad-Bengaluru, Hyderabad-Chennai, Chennai-Bengaluru, Delhi-Varanasi, and Varanasi-Siliguri.

Q. How does the budget help the IT sector?

It introduces a common safe harbour margin of 15.5% and increases the threshold to ₹2,000 crore.

Q. What is the Biopharma SHAKTI initiative?

It is a ₹10,000 crore program designed to build an ecosystem for the domestic production of biologics.

Q. Has the personal import duty changed?

Yes, the tariff rate on dutiable goods imported for personal use has been reduced from 20% to 10%.