Introduction

- Presented by Finance Minister Smt. Nirmala Sitharaman in the new Kartavya Bhawan.

- The Budget is founded on three 'Kartavyas': Economic Growth, Fulfilling Aspirations, and Inclusive Development (Sabka Sath, Sabka Vikas).

- Aims to balance global integration with domestic resilience amidst volatile global dynamics.

Macro-Economic Indicators

Total Expenditure

₹53.5 Lakh Crore

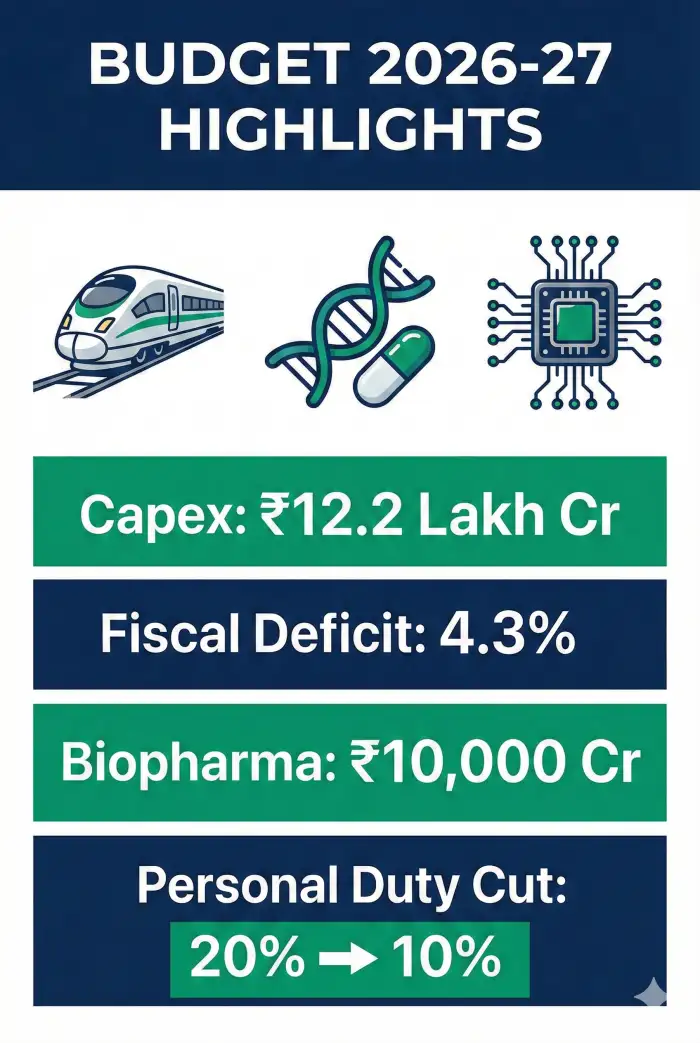

Fiscal Deficit Target

4.3% of GDP

Net Tax Receipts

₹28.7 Lakh Crore

Capital Expenditure

₹12.2 Lakh Crore

Debt-to-GDP Ratio

55.6%

Strategic Economic Interventions

- Biopharma SHAKTI: Launch of a new strategy with an outlay of ₹10,000 crore to create a global biopharma hub.

- Electronics Push: Electronics Components Manufacturing Scheme outlay increased to ₹40,000 crore.

- Semiconductors: Launch of India Semiconductor Mission (ISM) 2.0 focused on Indian IP and supply chains.

- SME Growth: A dedicated ₹10,000 crore SME Growth Fund to create "Champion SMEs".

- Container Manufacturing: A new scheme with ₹10,000 crore allocation to boost domestic container production.

Infrastructure & Green Energy

- High-Speed Rail: Development of 7 Corridors including Mumbai-Pune and Delhi-Varanasi.

- Waterways: Operationalization of 20 new National Waterways over the next 5 years.

- Carbon Capture: Allocation of ₹20,000 crore for Carbon Capture Utilization and Storage (CCUS) technologies.

- City Development: ₹5,000 crore per city for developing City Economic Regions (CER).

Taxation Reforms & Ease of Living

- New Legislation: The New Income Tax Act, 2025 will be effective from April 1, 2026.

- Personal Imports: Customs duty on goods for personal use slashed from 20% to 10%.

- TCS Reduction: Tax Collected at Source on overseas tour packages reduced to 2%.

- IT Sector Relief: Safe harbour margin fixed at 15.5% with threshold increased to ₹2,000 crore.

- Foreign Cloud Services: Tax holiday provided until 2047 for foreign companies using Indian data centers.

Source Information

Original Source: Ministry of Finance via PIB Delhi.

Link: Read Official Highlights

Frequently Asked Questions

Q. What is the total budget expenditure estimated for 2026-27?

The total expenditure is estimated at ₹53.5 lakh crore.

Q. How is the budget supporting the Biopharma sector?

The government has launched Biopharma SHAKTI with an outlay of ₹10,000 crores and plans to set up 3 new NIPERs.

Q. What are the major changes in Customs Duty for individuals?

The tariff rate on dutiable goods imported for personal use has been reduced significantly from 20% to 10%.

Q. What is the new fiscal deficit target?

The fiscal deficit for BE 2026-27 is estimated to be 4.3% of GDP.

Q. Are there any benefits for students studying abroad?

Yes, the TCS rate for remittances related to education and medical purposes under LRS has been reduced from 5% to 2%.